August 3, 2023

MBA, Groups: CCCA Would Cause Devastating Harm

MBA joined state financial trade associations in urging Sens. Josh Hawley and Eric Schmitt to oppose legislation that would leave consumers with fewer choices and decreased access to credit while local banks and credit unions would be harmed by even more government intervention.

MBA, the Missouri Credit Union Association and Missouri Independent Bankers Association said the deceptively titled Credit Card Competition Act gives enormous power to government bureaucrats by putting the Fed in charge of the U.S. credit card system and placing a federal mandate on card networks and routing.

“The fine print shows this legislation requires banks and credit unions to pay for the enormous cost of rewiring how credit cards are processed under the guise of increased competition. But the market is already competitive,” they said. “There are currently thousands of credit card issuers, many of which are small banks and credit unions. The increased costs stemming from this bill will make it more difficult for them to compete, and some will be driven out of offering credit cards completely.”

They added that the bill props up highly profitable big box retailers while harming Missouri families and financial institutions.

“At the end of the day, this bill means consumers have fewer choices, their access to credit is decreased, and local banks and credit unions are harmed by even more government intervention,” they said.

The CCCA was introduced in the Senate in June by Sens. Dick Durbin, D-Ill., and Roger Marshall, R-Kan., with a companion bill introduced the House. Before adjourning last week, the Senate passed a major defense spending bill that excluded CCCA. Several financial associations urged lawmakers to reject attempts by Durbin and Marshall to attach the legislation as an amendment to the National Defense Authorization Act, a must-pass bill that establishes annual appropriations for the U.S. Department of Defense.

The Senate version of the NDAA must now be reconciled with a version previously passed by House, providing CCCA supporters with further opportunities to attach their legislation to the defense bill. MBA encourages bankers to contact their lawmakers and urge them to oppose this measure.

Federal Judge Delays Section 1071 Compliance Dates

TBA, ABA call on CFPB to extend 1071 stay to all FDIC-insured banks

Today, the American Bankers Association and the Texas Bankers Association called on the Consumer Financial Protection Bureau to extend a federal judge’s court order pausing the CFPB’s 1071 final rule implementation to all FDIC-insured banks.

As MBA shared earlier this week, a federal judge in Texas issued an order blocking enforcement of Section 1071 while the U.S. Supreme Court hears a challenge to the constitutionality of the CFPB’s funding structure. The injunction came at the request of the ABA, TBA and McAllen, Texas-based Rio Bank in litigation challenging the 1071 rule.

Although the judge granted ABA and TBA’s request for an injunction, the judge did not accept ABA’s and TBA’s request for the injunction to apply to all financial institutions covered by the rule. Instead, the judge chose to provide relief only to TBA and ABA member banks across the country.

In today’s letter to CFPB Director Rohit Chopra, ABA and TBA said they “requested relief for every entity subject to the final rule, but the court limited that relief to members of our associations. While most FDIC-insured banks fall within our membership, there are some that do not. We recognize the bureau’s desire to continue pressing forward with certain covered institutions and so are only asking for your consideration of extending the stay to the banking industry. We believe this would simplify things for both your agency and the regulated community.”

The relief under the court order applies while the Supreme Court hears the constitutional challenge to the CFPB in CFPB v. Community Financial Services Association of America, which is scheduled to be argued in October. A decision could be released any time before the end of June 2024, at which point new compliance deadlines would be issued for ABA and TBA members.

ABA is hosting a free webinar at 10 a.m. Friday for ABA members and nonmembers to provide an update on what the decision means for banks.

Before adjourning last week, the House Financial Services Committee approved a resolution of disapproval of the CFPB’s final rule implementing Section 1071. The resolution would need to be adopted by both houses of Congress and signed by the president to overturn the rule. As previously shared, MBA urges bankers to voice their support of the resolution to their representatives and also encourages your small business customers to express their support.

ATM Stickers Warn of New State Felony Penalties

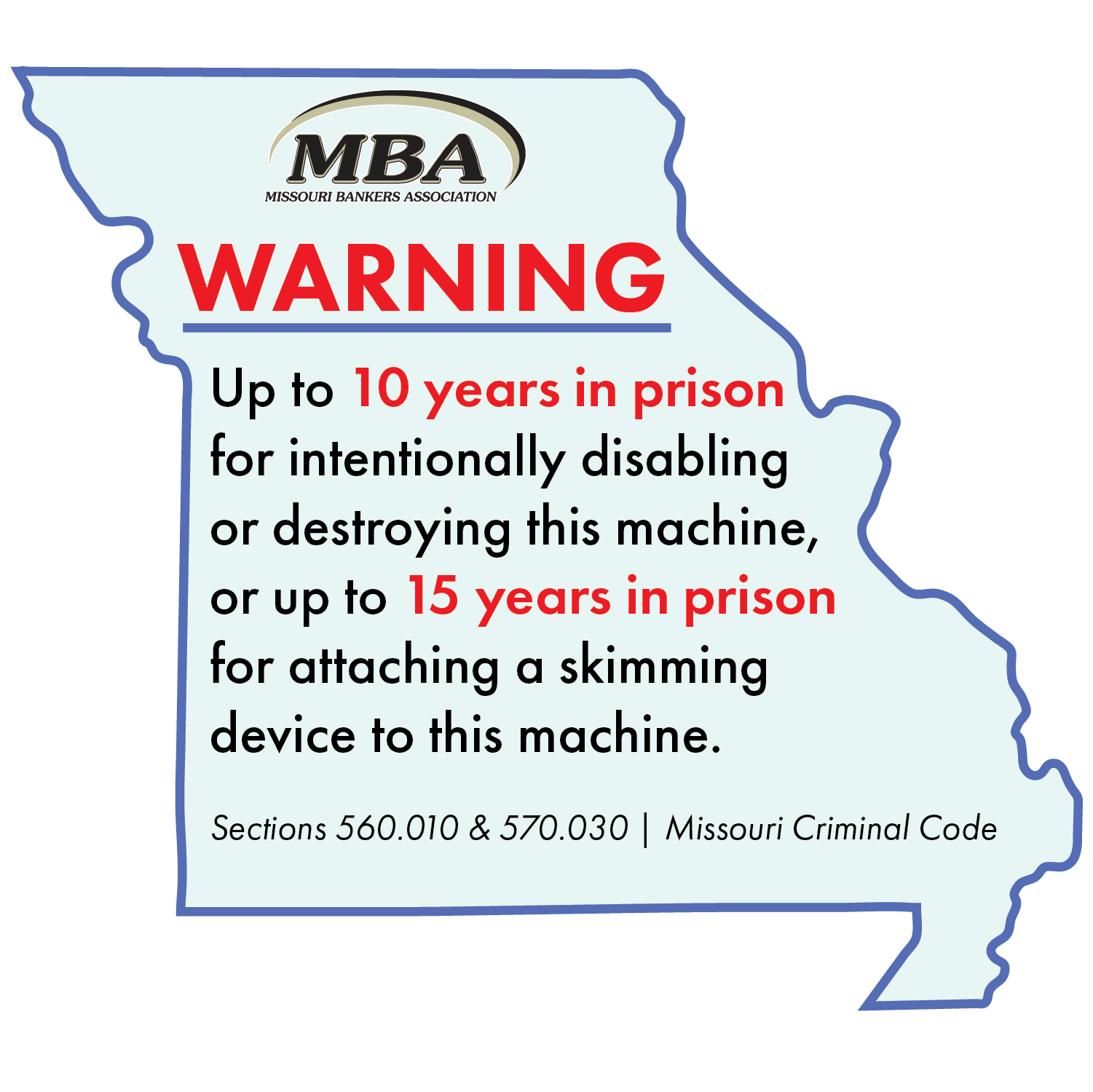

Effective Aug. 28, destroying an ATM (known as a “smash-and-grab” crime) or attaching a skimming device to an ATM will be a felony offense in Missouri. Senate Bill 186 passed this spring by the Missouri General Assembly established new penalty provisions ranging from class D to class B felony, with punishment up to 10 years in prison for intentionally disabling or destroying an ATM machine or up to 15 years in prison for attaching a skimming device to the machine.

Effective Aug. 28, destroying an ATM (known as a “smash-and-grab” crime) or attaching a skimming device to an ATM will be a felony offense in Missouri. Senate Bill 186 passed this spring by the Missouri General Assembly established new penalty provisions ranging from class D to class B felony, with punishment up to 10 years in prison for intentionally disabling or destroying an ATM machine or up to 15 years in prison for attaching a skimming device to the machine.

To raise awareness of this new statute, MBA has created stickers to place on ATMs. Placement of these stickers is not required. However, the intent is to warn criminals of the new felony penalties and alert law enforcement and local prosecutors of the section of the Missouri Criminal Code (Sections 560.010 & 570.030) under which these crimes may be prosecuted.

The stickers are free for MBA member banks. To request stickers or for more information, contact MBA Senior Vice President David Kent.

State Implements New Securities Rule

A new state securities rule proposed by Missouri Secretary of State Jay Ashcroft took effect July 31. The rule requires a new disclosure and each customer’s signed consent for broker-dealers, investment advisors and investment advisor representatives who purchase or sell a security or commodity on behalf of a customer where the advisor or broker has applied or used criteria other than maximization of financial return to the customer and has incorporated nonfinancial, social or environmental goals in recommendations or advice. The rule also requires the disclosure to be provided to the customer annually and written consent to be signed by the customer at least once every three years.

MBA previously notified bank leaders about this rule and will continue to keep members informed of relevant developments.

KC Fed Names Schmid New President, CEO

Jeffrey R. Schmid has been appointed president and CEO of the Federal Reserve Bank of Kansas City, effective Aug. 21.

Schmid currently serves as the president and CEO of the Southwestern Graduate School of Banking Foundation at Southern Methodist University’s Cox School of Business. He has more than 40 years of banking and regulatory experience, including positions at the Federal Deposit Insurance Corporation and in leading the establishment of Mutual of Omaha Bank, where he served as chairman and CEO.

Schmid succeeds Esther L. George, who retired from the bank Jan. 31 as required by mandatory Federal Reserve retirement rules for presidents. He will complete the remainder of George’s five-year term as president that ends Feb. 28, 2026. At that time, Schmid will be considered for reappointment under a process established by the Board of Governors. As president of the Federal Reserve Bank of Kansas City, Schmid will rotate with other regional Reserve Bank presidents as a voting member on the Federal Open Market Committee, which has authority over U.S. monetary policy. He will participate in FOMC meetings upon his start date and will be a voting member of the committee in 2025.

Stablecoin Bill Moves Forward in House

The House Financial Services Committee voted to advance out of committee legislation introduced by Chairman Patrick McHenry, R-N.C., that would establish a regulatory framework for stablecoins. H.R. 4766 would allow state banking regulators to approve and supervise nonbank stablecoin issuers. As previously shared by MBA, banking and credit union associations have said the model proposed in the legislation is insufficient to provide the strong regulatory oversight needed to ensure effective consumer protection, financial stability and a level regulatory playing field. The trade associations instead urged that stablecoin issuers be subject to at least the same form of supervision from a federal regulator as state-chartered banks and credit unions.

ABA Urges Senate Leaders to Support ACRE Act

A bill that would make it easier for farmers and rural families to access real estate credit is a bipartisan solution that will help sustain and grow rural America, the American Bankers Association said in a letter

Farmers and ranchers are facing skyrocketing costs on everything from fertilizer to pallets, and rising interest rates are making it more difficult to purchase agricultural land and finance existing operations, ABA said. The Access to Credit for our Rural Economy Act would exclude from gross income the interest received by a qualified lender on all loans secured by farm real estate and aquaculture facilities. It also would exclude the interest received by a qualified lender on home mortgage loans that do not exceed $750,000 in rural communities of no more than 2,500 people.

“In an intensely competitive lending market, these tax savings would be passed along to borrowers in the form of lower interest rates on loans secured by farm real estate and aquaculture facilities, saving farmers and ranchers approximately $950 million per year,” ABA said, noting that the ACRE Act puts homeownership back within reach and stems population loss in rural communities by lowering the interest rate on qualified mortgages by an estimated 0.5% to 1.5%. “Finding bipartisan solutions to reduce interest rates in this environment is extremely important to American agriculture and rural America,” ABA said.

As previously shared by MBA, ACRE mirrors the mirrors the Enhancing Credit Opportunities in Rural America Act, known as ECORA, that was introduced in the last Congress. MBA President and CEO Jackson Hataway has shared ACRE will provide critical economic support to rural communities.

“MBA is working with our congressional delegation to sign on to support this bipartisan measure, and we encourage our members to let their representatives know how this bill will benefit their customers and rural communities,” Hataway said.